Rebalancing

Rebalancing is the act of exchanging one type of asset for another. This occurs when new investments are purchased, growth of investments occurs, or losses are seen in one asset class or another. With a properly diversified portfolio, you should see asset classes becoming out of sync as equities are likely to outpace bonds. This especially holds true if you are investing additional funds into equities in other accounts and don’t add new bonds.

Once you have identified your asset allocation target, you should aim to keep it roughly at that balance.

This can be done in a few ways:

- Rebalancing at a defined time of year - There are people who aim to rebalance a few times a year, semi-annually, quarterly, what have you. The key thing is sticking to a schedule. Don’t try to time the market. In the longer timelines, individual trades matter very little.

- Rebalancing via contributions - Depending on how much you are able to save throughout the year, rebalancing could be as easy as changing where your investments are automatically invested in across your multiple accounts. However, please familiarize yourself with tax optimal investing within tax advantaged accounts. The tax inefficiency of holding bonds in Roth, for instance, likely offsets the annoyances it takes to rebalance via something like #1.

- Rebalance actively - Let’s be honest, it’s super easy to trade now a days. Within tax advantaged accounts, trades have no tax implications, and therefore super easy to just click a few buttons and be done. I am guilty of market timing during the March decline we experienced, but did so with a defined plan. I rebalanced twice a week but in accordance with my asset allocation target. This led to me maintaining my asset allocation through the down turn, and now I’m overweighted in equities as a result of the subsequent gains we’ve seen in the recent months. Again, this should only be done within tax advantaged accounts if possible, as trades in taxable brokerage accounts will result in capital gains/losses (potentially wash sales)

- “circuit breaker” rebalancing - Set a percentage of being off in one asset class or another (i.e. if a segment is off by 10% of your target, so a 60% US equity allocation reaching 66% would be a trigger to rebalance). This can lead to you being more active than say, #1 or #2, but less active than #3 because it would take another amount of time to be out of balance again.

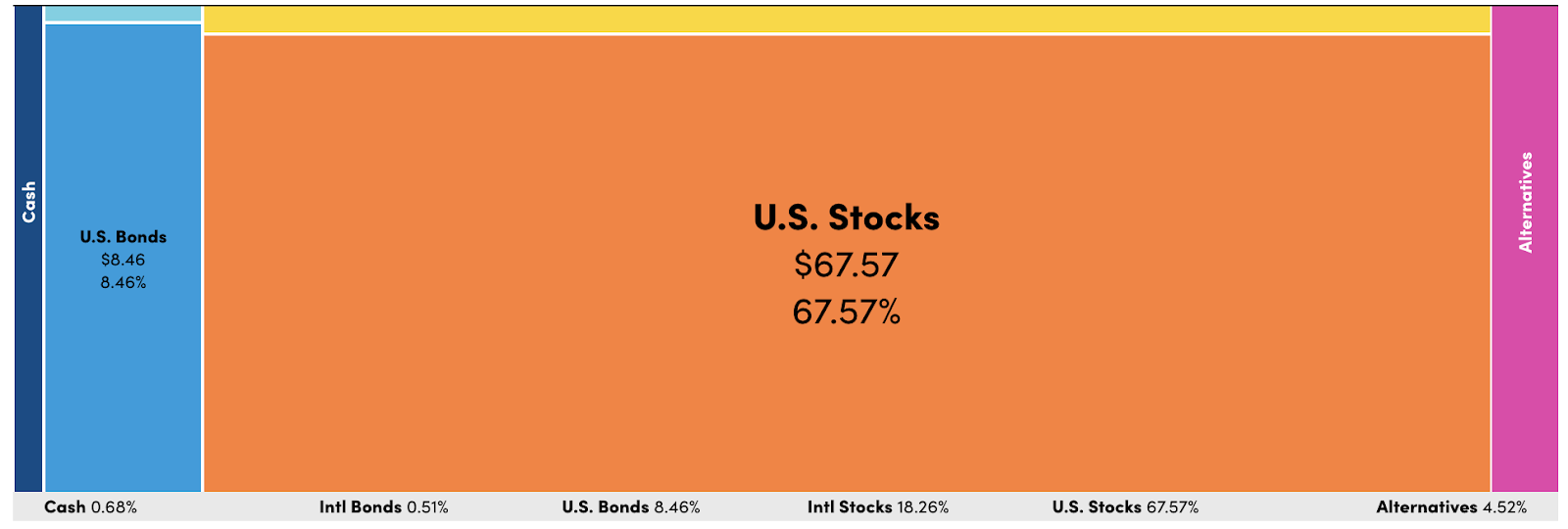

Tools like Personal Capital’s asset allocation view (see screenshot below) help visualize and categorize your asset allocation. The math is generally easy to do. See example:

For the sake of anonymity, let’s pretend I have $100,000 and my allocation is as defined in the screenshot below. My asset allocation goal is 60% US stocks, 20% Int. stocks, 5% alternatives, and 15% bonds (let’s pretend 5% int bonds, and 10% US bonds, let’s lump cash into int. bonds).

I am 7.57% over in US Stocks, meaning I need to move $7,570 out of US equities. $1,740 intl, $1,540 in US Bonds, $3,810 in Intl Bonds (Cash 0.68% + 0.51% intl), and the remainder in alternatives (if you did the math, $480, which is 0.48% and the missing % needed for alternatives!)

The process, if investing in index funds (hint hint), is to sell US Equities (VTSAX in my case), then use the cash to cover the remainder. I would buy $1,540 in VBTLX, $3,810 in VTIBX, $480 in VGSLX (REIT), and $1,740 of VGTSX. This example is assuming these index funds are 100% of each category, and not composed of things like cash, or that VTSAX doesn’t include real estate holdings. In addition, rebalances are needed to be done on a holistic level, meaning you may not have $7,570 of US equities in an account that you want to buy REITs in.

I will guarantee that rebalancing is never precise. However, I also guarantee that if you absolutely nailed it, the next day it would be off again. This is a “best effort” operation within terms of investing. In the long run, a few percentage points one way or the other won’t matter much. Ignoring it over a long period of time, however, will!

Did you like what you read? Was it helpful? Help spread the information! I don't advertise and I surely can't compete on SEO alone.

Would you like to be notified of new articles? Join the Trello board.. It is set up to email whenever an article ticket is moved into the done column! The invite link will also allow you to file a bug or feature request if you'd like!